In this guide, we’ll explain what market volatility is, how it affects your portfolio, and practical strategies to help you stay calm and invest wisely during uncertain times.

What Is Market Volatility?

Market volatility refers to the rapid and significant movement of stock prices over a short period. It can result in sharp gains or losses, driven by factors like:

- Economic data releases.

- Geopolitical events.

- Corporate earnings reports.

- Market sentiment and speculation.

- Measuring Volatility:

- The VIX (Volatility Index) is often called the “fear gauge,” measuring market expectations for volatility.

Why Volatility Matters for Investors

- Creates Opportunities

- Volatility can often lead to discounted stock prices, providing opportunities for long-term investors to buy certain assets at lower prices.

- Impacts Short-Term Performance

- Sharp price swings can temporarily reduce your portfolio’s value, but staying focused on long-term goals helps mitigate this impact.

- Tests Emotional Discipline

- High volatility can trigger fear-based selling or greed-driven buying, leading to poor decisions.

Common Causes of Market Volatility

- Economic Factors

- Changes in interest rates, inflation, or unemployment data can influence market performance.

- Earnings Reports

- Positive or negative surprises in corporate earnings can trigger significant stock price movements.

- Geopolitical Events

- Trade wars, political elections, or global conflicts can lead to uncertainty, driving volatility.

- Market Sentiment

- Investor behavior, driven by fear or optimism, can amplify market swings.

How to Stay Calm During Volatile Markets

1. Focus on Your Long-Term Goals

- Remember why you’re investing in the first place—whether it’s for retirement, education, or wealth building, or something else.

- Volatility will vary over time, but long-term growth is the goal.

2. Diversify Your Portfolio

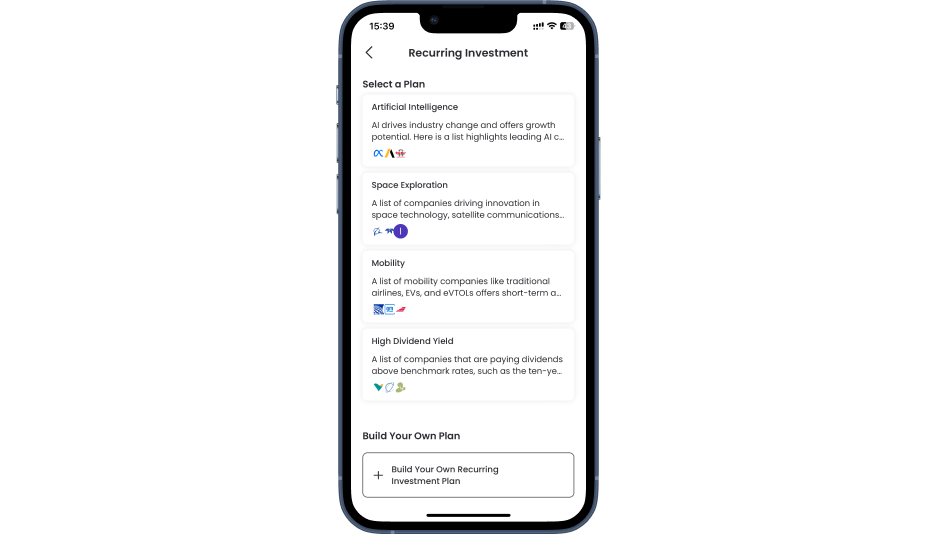

- Spread your investments across asset classes (such as stocks, bonds, real estate) and sectors to reduce risk.

- How Tradesk Can Help: Use Tradesk’s portfolio insights to evaluate and improve diversification.

3. Stick to a Consistent Investment Strategy

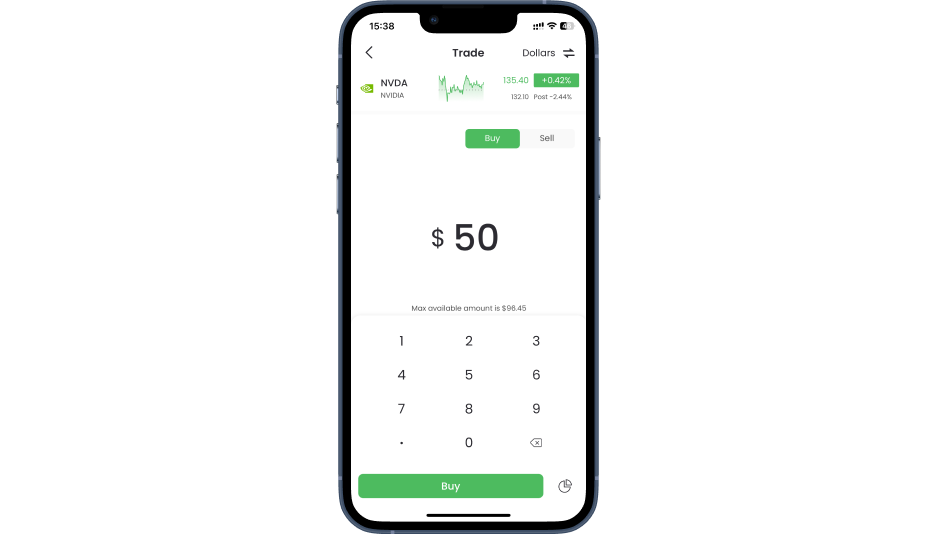

- Dollar-cost averaging allows you to invest steadily, regardless of market conditions.

- Example: Investing $500 monthly ensures you buy more shares during dips and fewer during peaks.

- Tradesk Feature Highlight: Automate recurring investments on the Tradesk platform to stay consistent.

4. Avoid Emotional Decisions

- Reacting to short-term market swings often leads to buying high and selling low.

- Tip: Take a step back and review your long-term plan before making any changes.

5. Reassess, Don’t Panic

- Volatility can be a good time to review your portfolio. Are you still aligned with your risk tolerance and goals?

- How Tradesk Can Help: Tradesk provides personalized insights and alerts to help you reassess and adjust as needed.

6. Take Advantage of Opportunities

- Market dips can be great buying opportunities for high-quality stocks or ETFs.

- Tip: Focus on long-term value rather than chasing quick gains.

7. Keep an Emergency Fund

- Having 3–6 months of expenses saved in cash may reduce your need to sell investments during downturns.

Common Mistakes to Avoid During Volatility

- Timing the Market

- Predicting highs and lows can be a difficult task. Focus on consistency instead.

- Overreacting to Headlines

- News cycles often exaggerate fear or optimism. Stick to your strategy.

- Ignoring Your Risk Tolerance

- Ensure your portfolio reflects your comfort level with volatility.

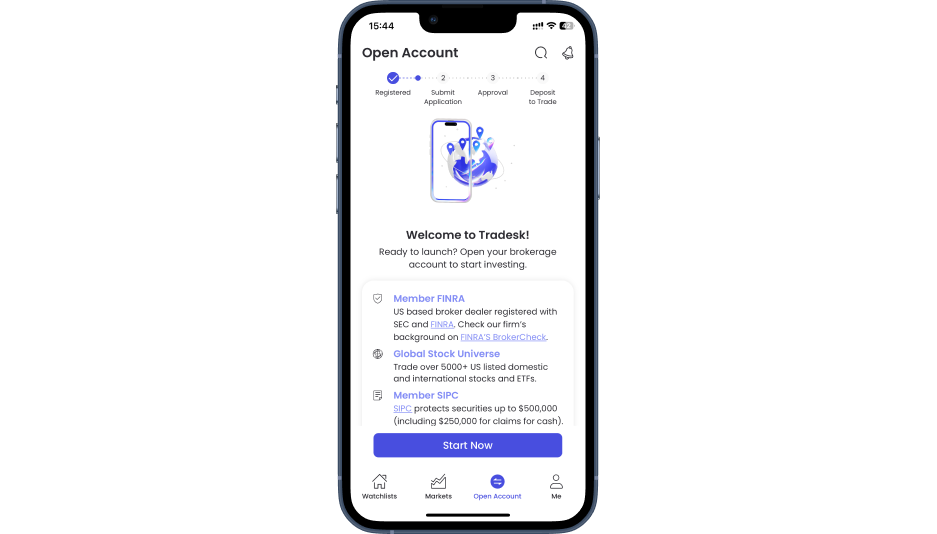

How Tradesk Supports Confident Investing

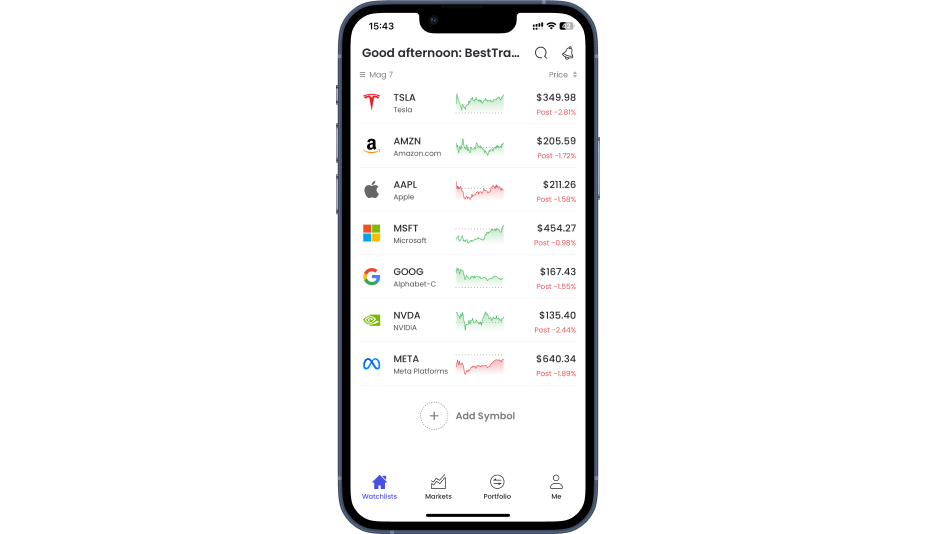

Tradesk’s platform provides tools to help you navigate market volatility:

- Real-Time Alerts: Stay updated on market changes and opportunities.

- Goal-Tracking Tools: Keep your long-term objectives front and center.

- AI Assistance: Tradesk’s AI-powered assistant, Lexi, offers personalized insights during turbulent times.

- Educational Resources: Learn how to manage risk and make data-driven decisions.

Conclusion

Market volatility can feel daunting, but it’s a normal part of investing. By focusing on your long-term goals, diversifying your portfolio, and using tools that Tradesk has to offer will help stay informed, and navigate uncertainty with confidence.

Ready to take control of your investments, even during volatile markets? Visit www.tradesk.co to access tools and resources designed to empower you.