When top executives and key stakeholders buy or sell shares of their own company, it can provide valuable clues about the company’s financial health and future prospects. Insider trading activity the buying and selling of stock by corporate executives, board members, and key employees—often reflects confidence or concern about a company’s future performance.

By tracking insider transactions, investors can gain an edge in understanding stock movements and refining their strategies.

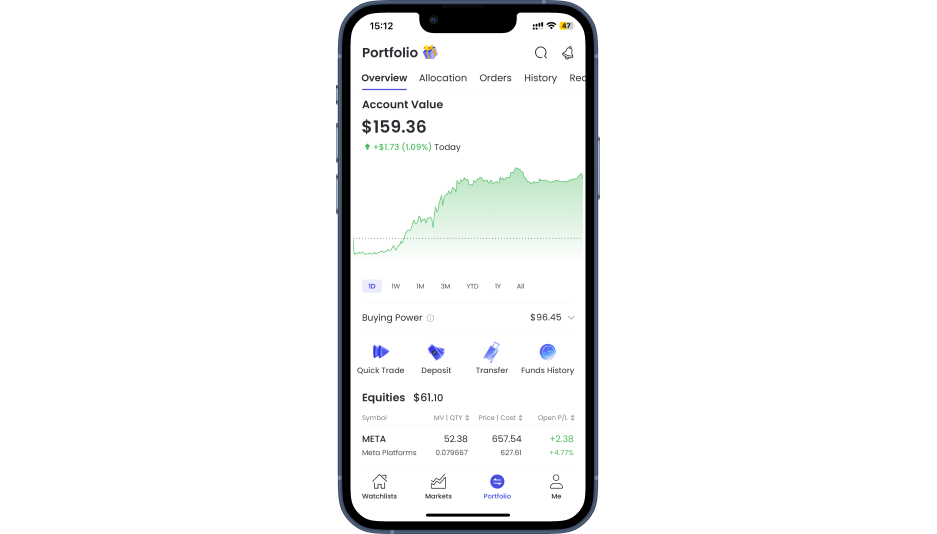

Tradesk now makes this easier than ever. Our platform’s built in Insider Trades feature gives investors a real time, visual breakdown of executive transactions so you can act on what the market’s decision makers are doing, not just what they’re saying.

By tracking insider transactions, investors can gain an edge in understanding stock movements and refining their investment strategies. This guide will explain what insider trading is, how to track it, and how to use this information to make smarter investment decisions.

What is Insider Trading?

Legal vs. Illegal Insider Trading

Insider trading refers to the buying or selling of stocks by company insiders. There are two types:

- Legal Insider Trading: When corporate executives and employees buy or sell stock while properly reporting their transactions to regulatory agencies, such as the SEC.

- Illegal Insider Trading: When insiders trade stocks based on material nonpublic information (such as upcoming earnings reports, mergers, or regulatory approvals) before it is disclosed to the public.

Understanding the difference is crucial, as illegal insider trading carries severe penalties, while legal insider trading can provide valuable insights for investors.

Why Insider Trades Matter to Investors

Executives and directors have deep knowledge of their company’s financial health and future prospects. Their buying and selling activity can serve as a signal for investors:

- Insider Buying: Often suggests confidence in the company’s future growth or undervaluation.

- Insider Selling: Could indicate concerns about the company’s stock price, upcoming challenges, or an overvalued market position.

It’s important to analyze these trades in context, as some executives may sell shares for personal financial reasons unrelated to the company’s outlook.

How Real Time Insider Trade Tracking Works

With Tradesk’s insider trade tracking, users can view trades to track specific companies, industries, or individual executives. The tool presents clear visualizations of insider activity, allowing users to spot trends, analyze patterns, and integrate this data into their market strategy. By observing what executives and board members are doing with their own shares, investors gain insights into a company’s potential trajectory, often months before results become publicly apparent.

How to Track Insider Trading Activity

Investors can monitor insider trades through publicly available data. In the U.S., the Securities and Exchange Commission (SEC) requires insiders to report trades via Form 4 filings.

1. Understanding SEC Form 4 Filings

Form 4 is a document that insiders must file with the SEC within two business days of any transaction. It includes:

- The name of the insider (CEO, CFO, director, etc.).

- The type of transaction (buy or sell).

- The number of shares traded.

- The price per share.

- The insider’s remaining holdings after the transaction.

These filings provide transparency and allow investors to monitor executives’ confidence in their own companies.

2. Where to Find Insider Trading Data

Several online resources aggregate insider trading information, making it easier for investors to track executive transactions:

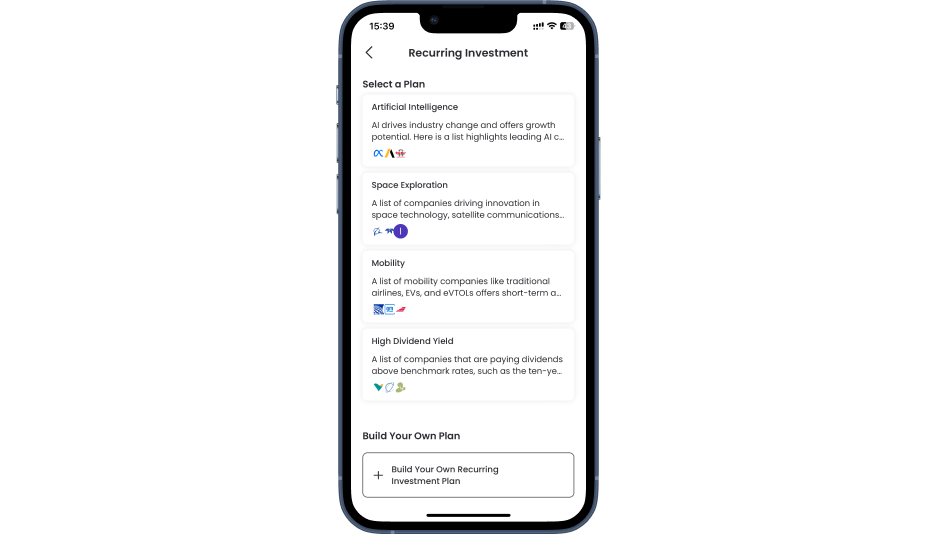

- Tradesk App – The insider trade tracking feature is now live on the Tradesk platform

- SEC EDGAR Database – The official source for all insider filings.

- FINRA Insider Trading Reports – Reports on insider trading trends and regulatory oversight.

- Market Data Platforms (Bloomberg, Reuters, Yahoo Finance, Finviz, and Tradesk’s research tools) – Provide consolidated insider trade data.

These tools help investors quickly access and interpret insider trading activity without manually searching SEC filings.

3. Key Metrics to Watch

Not all insider transactions are meaningful. To distinguish valuable signals from noise, consider the following factors:

- Large Insider Purchases: If an executive buys a substantial stake, it often signals strong confidence in future performance.

- Consistent Buying Activity: Repeated insider purchases suggest a sustained belief in the company’s long-term success.

- High-Ranking Executives: Trades by CEOs, CFOs, and board members are more informative than those by lower-level employees.

- Cluster Buying: When multiple executives buy shares at the same time, it can indicate a broader consensus that the stock is undervalued.

- Ratio of Buying vs. Selling: While selling can be due to personal financial reasons, a high ratio of buying over selling is a strong bullish indicator.

Practical Applications for Everyday Investors

This insider trading feature is designed to provide actionable insights for various investor types:

- Growth Investors can help identify high conviction buys from company leaders, signaling growth opportunities.

- Value Investors can help leverage insider data to spot undervalued companies where insiders are increasing their stakes.

- Short-Term Traders can help monitor insider trades to capitalize on short-term market reactions, aligning with the timing of these moves.

By making insider trade tracking accessible, Tradesk is shifting the dynamics of the market, leveling the playing field between retail investors and institutional players.

How to Use Insider Trading Data in Your Investment Strategy

1. Confirming Investment Decisions

Investors can use insider trading data to validate their stock selections. If you’re considering buying a stock and notice that multiple insiders are also buying, it can reinforce your conviction.

2. Spotting Undervalued Stocks

Insider buying is often seen in stocks that executives believe are trading below their fair value. Monitoring such trades can help investors identify promising buying opportunities before the broader market recognizes them.

3. Avoiding Overhyped Stocks

If company insiders are aggressively selling their shares, it may indicate that the stock is overvalued or facing potential downturns. While insider selling isn’t always a red flag, a pattern of large sales can suggest caution.

4. Timing Entry and Exit Points

Tracking insider transactions can help investors fine-tune when to enter or exit a position. If a company sees an uptick in insider buying after a price dip, it may indicate a buying opportunity. Conversely, if insiders start selling after a prolonged rally, it could signal a potential correction.

Additional Insights on Insider Trading

1. Case Studies of Insider Trading Influence

Real-world examples help illustrate the power of insider trading analysis. For example, Tesla’s stock surged in 2020 after Elon Musk made substantial insider purchases. Similarly, major insider selling before the collapse of Enron served as an early warning sign for investors.

2. Using AI to Detect Insider Trading Trends

Artificial intelligence is increasingly used to analyze insider transactions, identifying patterns and anomalies that human investors might miss. AI-driven platforms can flag unusual trading activity, helping traders act faster on emerging trends.

3. Sector-Based Insider Trading Patterns

Different industries have varying norms for insider trading. In the technology sector, insider buying is more common when launching innovative products, whereas in biotechnology, insiders may buy stock ahead of clinical trial results. Understanding sector-specific trends can enhance insider trading analysis.

Conclusion

Monitoring insider trading activity is a powerful tool that provides valuable insights into executive sentiment and company performance. By tracking Form 4 filings, analyzing transaction patterns, and distinguishing between meaningful trades and noise, investors can make more informed investment decisions.

While insider trading data should not be the sole basis for making investment decisions, it can serve as a valuable confirmation tool when used alongside financial analysis and market trends.

Want to track insider trading data more effectively? Explore Tradesk’s research tools for real-time insider trading insights and smarter investing decisions!

insights and smarter investing decisions!