In this guide, we’ll show you how to set SMART financial goals, why they matter, and how Tradesk’s tools can help you stay on track.

What Are SMART Goals?

SMART is an acronym that stands for:

- Specific: Clearly define what you want to achieve.

- Measurable: Include metrics to track your progress.

- Achievable: Ensure your goals are realistic based on your resources and timeline.

- Relevant: Align your goals with your broader financial priorities.

Time Bound: Set a deadline to achieve your goal

Why Financial Goals Matter for Investors

- Provide Clarity:Goals help you identify your “why” behind investing, whether it’s saving for retirement or building an emergency fund.

- Prevent Emotional Decisions

With clear goals in place, you’re less likely to make impulsive choices based on short-term market fluctuations. - Measure Progress

SMART goals give you benchmarks to track your financial journey.

How to Set SMART Financial Goals

1. Start with a Specific Goal

Avoid vague objectives like “I want to save money.” Instead, define exactly what you’re aiming for.

- Example: “I want to save $20,000 for a down payment on a house.”

2. Make It Measurable

Add a clear metric to track your progress.

- Example: Instead of “I want to save for retirement,” set a target like, “I will save $500 monthly to reach $250,000 by age 60.”

3. Ensure It’s Achievable

Set goals that challenge you but remain realistic given your income, expenses, and lifestyle.

- Example: If you can afford to invest $200 per month, don’t set a goal requiring $500 monthly contributions.

4. Keep It Relevant

Focus on goals that align with your financial priorities.

- Example: If building an emergency fund is a higher priority than investing in stocks, allocate funds accordingly.

5. Set a Time-Bound Deadline

Create urgency by setting a specific timeline for your goal.

- Example: “I will save $5,000 for a vacation in 18 months.”

Common Pitfalls to Avoid

- Setting Unrealistic Goals

If your goals are too ambitious, you risk feeling discouraged and giving up. - Neglecting Priorities

Focusing on low-priority goals can delay progress on more important ones. - Failing to Track Progress

Without regular check-ins, it’s easy to lose sight of your goals.

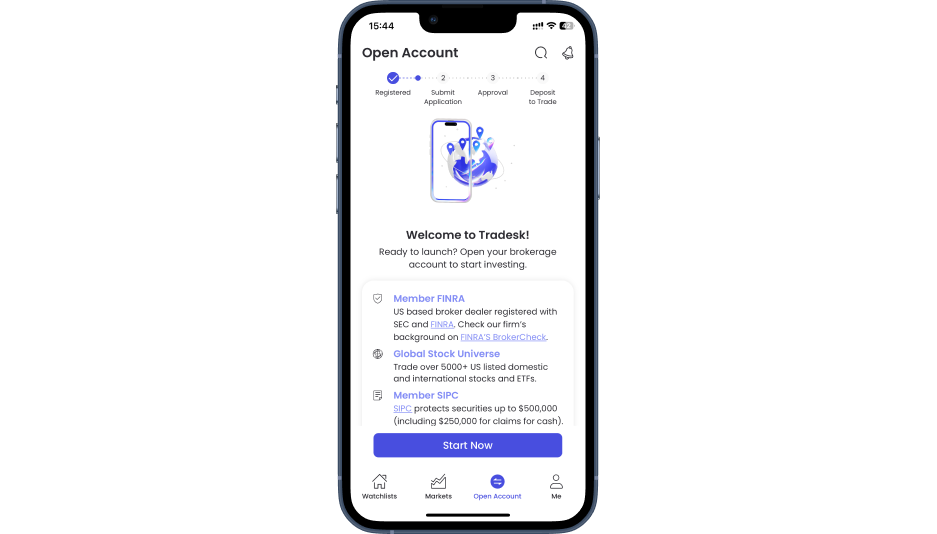

How Tradesk Can Help You Set and Achieve Financial Goals

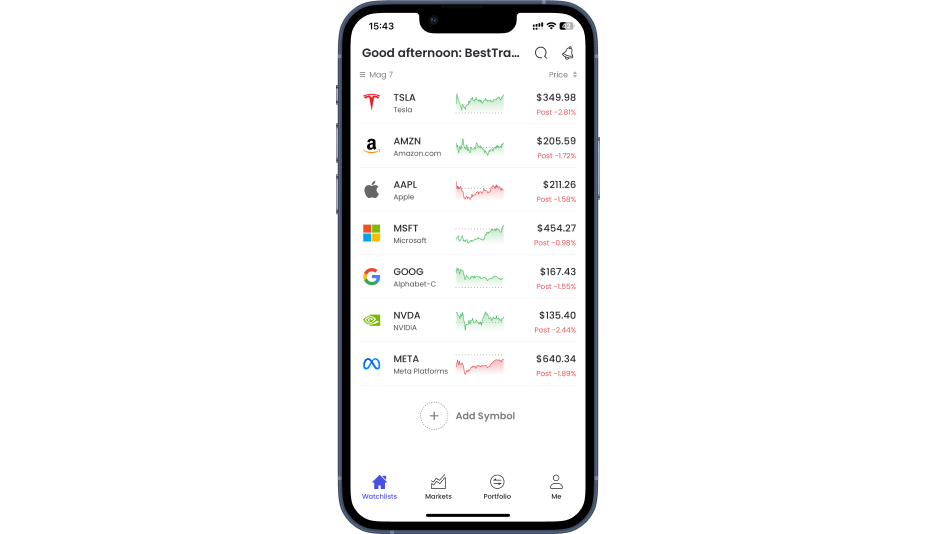

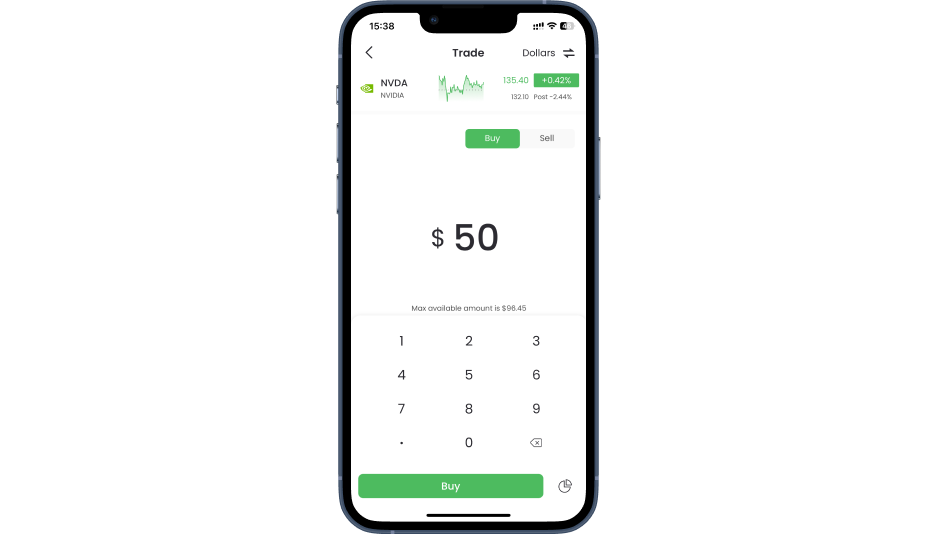

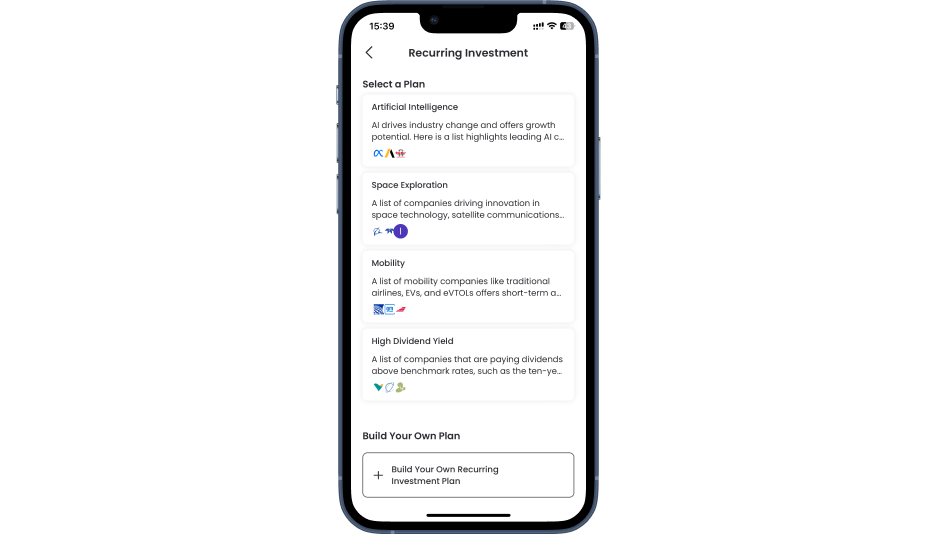

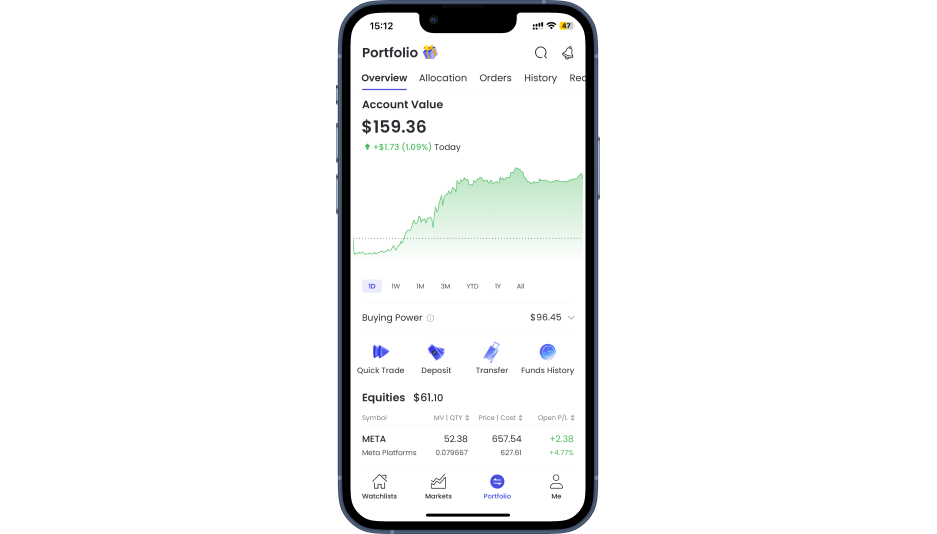

Tradesk’s platform includes tools designed to make goal-setting simple and actionable:

- Goal-Tracking Features: Monitor your progress with real-time updates.

- Customizable Plans: Create investment strategies tailored to your specific goals.

- Educational Resources: Learn how to prioritize and manage your financial objectives.

- AI Guidance: Tradesk’s AI assistant, Lexi, offers personalized tips to keep you on track.

Tips for Staying on Track

- Automate Your Savings

Set up automatic contributions to ensure consistent progress toward your goals. - Break Goals Into Milestones

Divide larger goals into smaller, achievable steps to stay motivated. - Review Regularly

Revisit your goals periodically to adjust for changes in income, expenses, or priorities.

SMART financial goals are the foundation of successful investing. By defining clear, actionable objectives and using tools like Tradesk to track your progress, you’ll feel confident in your ability to achieve your financial aspirations.

Ready to set your goals and start investing? Visit www.tradesk.co to access tools and resources designed to help you plan and achieve your financial future.

Set your SMART financial goals today. Sign up at www.tradesk.co and discover tools designed to simplify your journey toward financial success.