This guide will introduce you to some of the most powerful options strategies, including covered calls, straddles, iron condors, and spreads, helping you take your trading game to the next level. Understanding these strategies allows traders to adapt to different market conditions, whether they expect high volatility, stable price movements, or slow upward trends.

Why Trade Advanced Options Strategies?

Before diving into specific strategies, it’s essential to understand why traders use advanced options trading techniques:

- Enhanced Risk Management: Options strategies can hedge against market downturns and limit losses by mitigating exposure to market swings.

- Higher Income Potential: Selling options premiums, such as with covered calls and cash-secured puts, generates steady income for traders looking for additional revenue streams.

- Increased Market Flexibility: Strategies like straddles and condors allow traders to profit in volatile and non-directional markets, maximizing gains in different scenarios.

- Leverage with Controlled Risk: Compared to buying stocks outright, options allow traders to control large positions with smaller capital, enhancing efficiency.

Now, let’s explore some of the most effective advanced options trading strategies and how they can be implemented effectively.

1. Covered Calls: Generating Income on Your Holdings

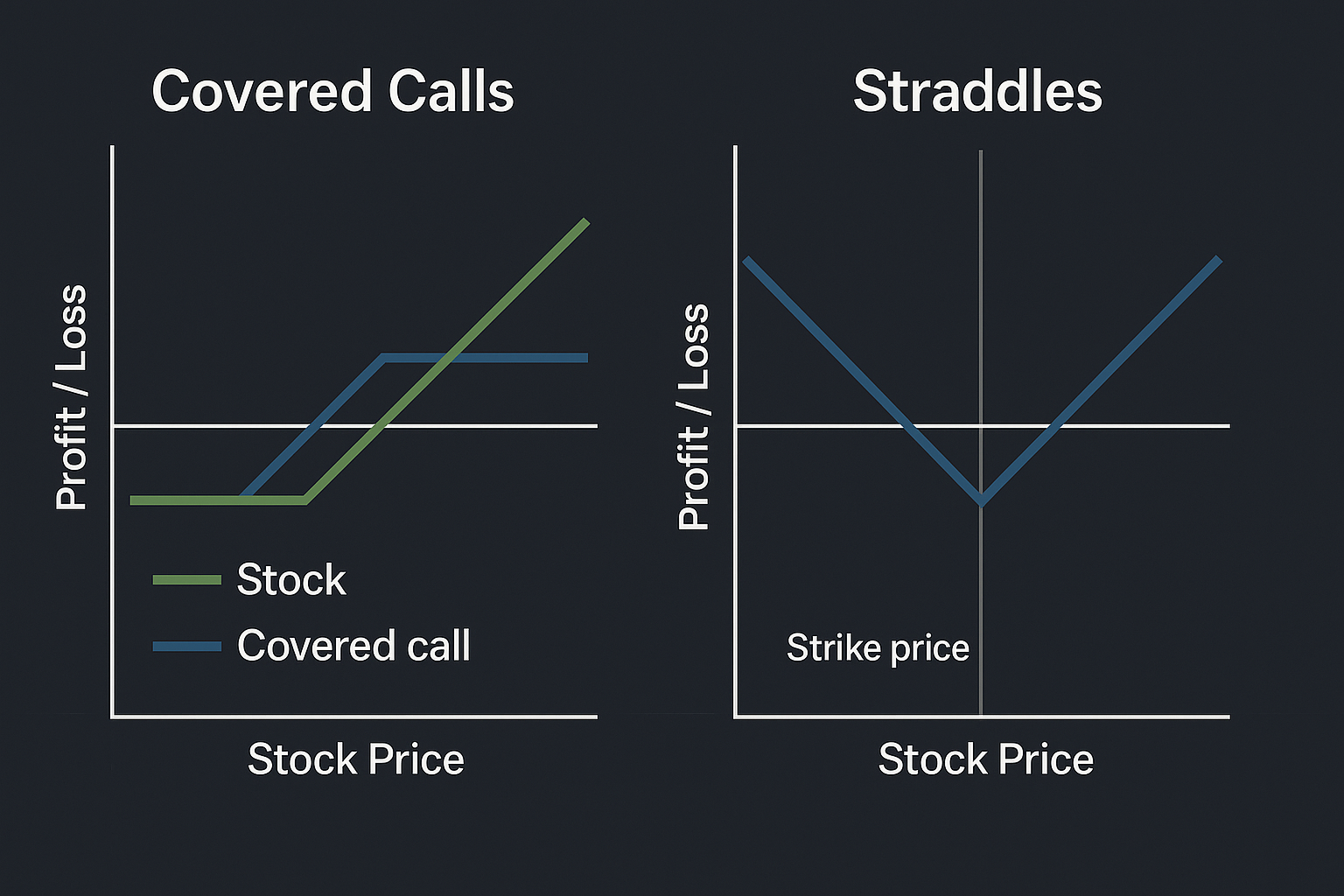

A covered call is an income-generating strategy where a trader sells a call option against a stock they already own. This allows the investor to collect a premium while limiting upside potential.

How it Works:

- The trader owns 100 shares of a stock.

- They sell a call option at a strike price above the current stock price.

- If the stock remains below the strike price, the trader keeps the premium and retains their shares.

- If the stock rises above the strike price, the shares are called away, and the trader earns both the premium and the stock’s price appreciation up to the strike price.

Best Use Case:

- Ideal for investors looking to generate passive income from their stock holdings while minimizing risk.

- Works best in neutral to slightly bullish markets, where stock appreciation is expected but limited.

- Used by long-term investors who want to profit from stocks they already own while reducing downside risk.

2. Straddles: Profiting from Volatility

A straddle is a market-neutral strategy that profits from large price swings in either direction. This strategy is particularly useful when traders expect a significant price movement but are uncertain about its direction.

How it Works:

- The trader buys both a call and a put option with the same strike price and expiration date.

- If the stock moves significantly up or down, one of the options will gain enough value to offset losses on the other.

- The strategy works best when expecting big price movements, such as before earnings announcements or economic reports.

Understanding the types of options is key here, as each option contract behaves differently in volatile conditions.

Best Use Case:

- When expecting high volatility, but uncertain about price direction.

- Ideal for earnings season, Federal Reserve rate decisions, or major company announcements.

- Works well when implied volatility is low, allowing traders to purchase options at a lower premium before a price breakout.

3. Iron Condors: Profiting in Low-Volatility Markets

An iron condor is a low-risk, limited-reward strategy that profits when a stock stays within a certain price range. This strategy is ideal for traders who expect little movement in the underlying stock.

How it Works:

- The trader sells both a put spread and a call spread.

- This creates a range in which maximum profit is achieved if the stock remains between the two short strikes.

- Losses are capped if the stock moves beyond the long options’ strike prices.

Best Use Case:

- Ideal for low-volatility markets, where stocks trade within a range.

- Often used in sideways or consolidating markets where no clear trend is forming.

- Works well with index ETFs or stable blue-chip stocks with predictable price ranges.

4. Debit & Credit Spreads: Balancing Risk and Reward

Debit Spread (Bull Call Spread / Bear Put Spread)

A debit spread is a directional strategy where traders buy an option and simultaneously sell another option at a different strike price to reduce the trade’s cost.

Example:

- Bull Call Spread: Buy a lower strike call, sell a higher strike call (used in bullish markets).

- Bear Put Spread: Buy a higher strike put, sell a lower strike put (used in bearish markets).

Credit Spread (Bull Put Spread / Bear Call Spread)

A credit spread generates income upfront by selling a higher-premium option and buying a lower-premium option.

Example:

- Bull Put Spread: Sell a higher strike put, buy a lower strike put (used in bullish markets).

- Bear Call Spread: Sell a lower strike call, buy a higher strike call (used in bearish markets).

Best Use Case:

- Debit spreads: When expecting a stock to move directionally with controlled risk.

- Credit spreads: When expecting a stock to stay within a range, generating income while limiting downside risk.

5. Calendar Spreads: Playing with Time Decay

A calendar spread involves buying a longer-term option while simultaneously selling a shorter-term option with the same strike price. This strategy takes advantage of time decay differences between short-term and long-term options.

How it Works:

- Traders benefit from greater time decay on the short-term option while holding a long-term position.

- If implied volatility increases near the short-term expiration, the spread gains value.

Best Use Case:

- When expecting steady price movement with increasing volatility.

- Works well around earnings reports, macroeconomic news, and industry trends where volatility increases over time.

Conclusion

Mastering advanced options strategies can take your trading to the next level, allowing you to generate consistent income, manage risk effectively, and profit from volatility.

Whether you’re using covered calls for passive income, straddles for volatility plays, or iron condors for range-bound markets, these strategies provide an edge in various market conditions. Understanding the right environment for each strategy ensures traders can maximize their risk-adjusted returns.

To see how to put these ideas into action, check out how to place an options trade using the Tradesk platform, and review when you can trade options to make sure you’re ready to go.

Want to learn more? Explore Tradesk’s educational resources and start implementing advanced options strategies today.