The September Effect: Myth, Market Truth, and What It Means for Investors in 2025

For decades, investors have whispered about September as the stock market’s “bad month.” It’s not superstition the data shows September has historically underperformed compared to the other 11 months. But like most things in markets, the truth is more nuanced.

As we enter September 2025, the so-called “September Effect” is worth another look. What does history really tell us? Why might this month be different from the rest of the calendar? And most importantly, how should investors think about positioning themselves during a seasonally volatile stretch?

What Is the September Effect?

The “September Effect” is the term used to describe a historical tendency for U.S. equities, particularly the S&P 500, to post weaker returns in September than in other months.

- Since 1950, the S&P 500 has averaged –0.6% to –0.7% in September, the lowest monthly average.

- The index has been positive in September less than half the time — roughly 44–45% of years.

- Outlier years stand out: September 2002 dropped nearly –11%, while September 2010 rallied more than +8%.

So, September isn’t always bad it’s inconsistent. Its reputation comes from the long-run averages, not from a guarantee of losses.

Why Does September Tend to Be Weak?

There’s no single explanation, but multiple forces may be at play:

Portfolio Rebalancing

Institutional investors often rebalance portfolios at the end of summer, adding selling pressure. After the relatively light trading of August, September typically brings heavier institutional activity, which can drag on performance.

Tax Planning

For some funds, September overlaps with fiscal year-end. That makes it a time for tax-loss harvesting, selling underperforming assets to offset gains. These sales can create temporary downward pressure on equities.

Investor Psychology

Markets are as much about sentiment as they are about fundamentals. With Q3 earnings season on the horizon and questions about year-end momentum, investors often lean defensive in September.

Seasonal Spending Shifts

In the broader economy, fall means back-to-school season. Families spend more on tuition, supplies, and other costs, sometimes tightening budgets. Investors worry this could weigh on consumer-driven growth, which ripples through equity markets.

Put together, these forces create a mix of caution and selling pressure that help explain why September’s returns often lag.

What History Really Shows

Looking back at more than 70 years of data:

- September is the weakest month on average. Since 1950, it has posted negative returns more often than positive.

- Losses are steeper than gains. When September is negative, the average decline is larger than the average positive return when it’s up.

But Q4 often rebounds. Historically, October through December have tended to deliver stronger returns, sometimes.

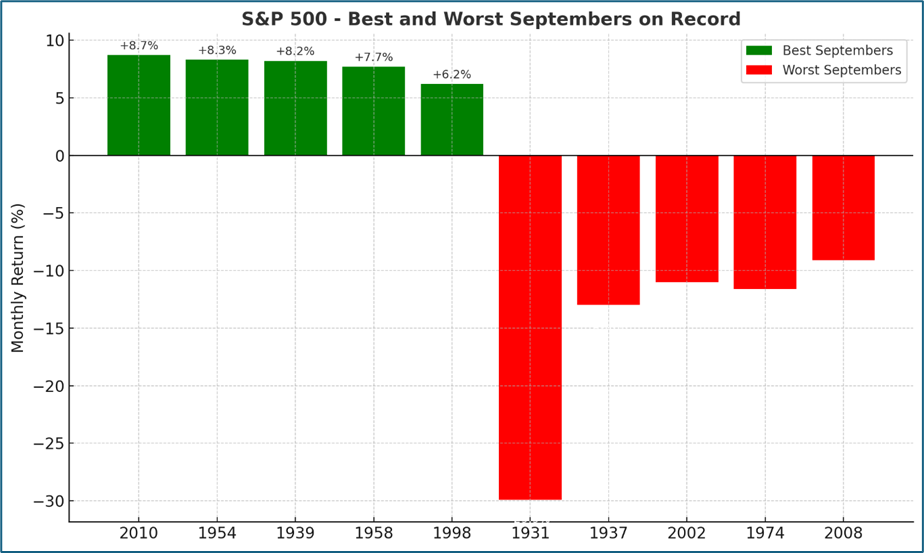

Best and Worst Septembers on Record

Here’s a snapshot of the extremes:

These numbers illustrate why September has the reputation it does — not because it always loses money, but because the downside years tend to be sharper and more memorable than the rallies.

A Global Perspective

Interestingly, the September Effect isn’t limited to the U.S. Other markets have shown similar tendencies. For example, studies on European and Asian indices reveal a comparable seasonal dip. This suggests the pattern may be tied not just to U.S. fiscal quirks, but also to global investor behavior.

The Limits of Seasonality

It’s important to stress: seasonality is descriptive, not predictive. Just because September has a weak historical average does not mean September 2025 will behave the same way.

- Different catalysts drive every year. In some years, September’s weakness aligned with recessions or crises. In others, strong earnings or policy shifts erased the trend.

- The market already knows the history. If investors expect September to be weak, some of that sentiment may already be priced in.

- Macro and policy factors dominate. Inflation, interest rates, Fed policy, and global events will always outweigh calendar quirks.

As one market strategist put it recently, “Seasonal trends make headlines, but fundamentals write the story.”

How Different Investors Approach September

Short-Term Traders

Day traders and swing traders often welcome September’s volatility. Sharp moves can create more trading setups, though they also raise risks. Tools like stop-losses and disciplined entry/exit plans become even more critical.

Long-Term Investors

For retirement savers or dollar-cost average, September is just another month. Short-term swings are less important than staying invested over decades. For these investors, weakness may even feel like opportunity to accumulate at slightly lower prices.

Institutions and Funds

Large players may treat September as a time to clean house, reposition portfolios, and lock in fiscal-year planning. That activity itself contributes to the very pattern individual investors watch.

What It Means for Investors in 2025

So how should investors approach this September?

- Volatility isn’t automatically negative. For some investors, it may mean more opportunities. For others, it simply reinforces the need to stay disciplined.

- Don’t treat history as a roadmap. Past seasonal averages don’t guarantee future outcomes.

- Risk management matters. Diversification, disciplined position sizing, and alignment with personal goals matter more than seasonal patterns.

- Watch the bigger picture. With Q3 earnings season beginning in October and the Fed meeting in November, September is more of a prelude than a finale.

The Tradesk Take

September’s reputation is real, but so is the rebound potential that often follows. That makes it a time to stay informed, flexible, and disciplined.

With the Tradesk app, you can:

- Track the S&P 500’s moves in real time.

- Build a watchlist and monitor volatility across sectors.

- Access educational resources in the Knowledge Place to better understand market drivers.

- Execute trades when you decide it’s the right moment.

Seasonality may raise eyebrows, but ultimately, your strategy should drive your decisions not the calendar.

What’s your move this September? Download Tradesk and take control.

Final Word

The September Effect has held up over decades, but it’s not a curse. It’s a reminder that markets move in cycles, investor behavior matters, and volatility is part of the investing journey. Whether 2025’s September ends red or green, having the right tools and mindset will matter more than any seasonal trend.